Being considered solvent means having the financial capacity to meet long-term expenses or debts. It’s about ensuring that your assets outweigh your liabilities. A solvency certificate serves as a declaration of an individual’s or company’s financial standing, often required for purposes such as standing as a surety, securing loans, or entering business contracts.

Typically, a solvency certificate is issued by either a government body or a bank. In this article, we’ll explore the detailed procedure for obtaining a solvency certificate from the government.

When you possess a solvency certificate, it indicates to others that you have the financial stability to take on certain commitments. This document holds significance in various scenarios, and understanding the process of obtaining it can be beneficial for individuals and businesses alike.

To acquire a government-issued solvency certificate, you’ll need to follow a specific procedure. This involves providing relevant financial information and documents to the concerned government body. The aim is to demonstrate that your assets surpass your liabilities, showcasing your ability to handle long-term financial responsibilities.

This certificate can be instrumental in situations where financial reliability is crucial, such as when vouching for someone, seeking loans, or securing business contracts. As government bodies are often involved in issuing these certificates, the process is typically formal and requires attention to detail.

Solvency Certificates play a crucial role in verifying the financial standing of individuals or businesses, and both government and commercial offices commonly require them for a variety of purposes. Here are some instances where Solvency Certificates are essential:

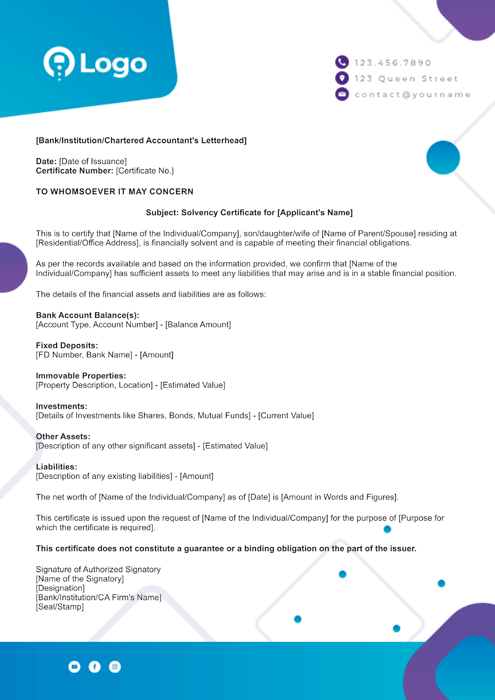

While the format of a Solvency Certificate remains generally consistent across most banks and issuing authorities, it’s essential to note that slight variations may exist. These differences could stem from the specific entity for which the certificate is issued. It is advisable to obtain the exact Solvency Certificate format from the issuing authority. Below is a generic outline that captures the common elements:

Date: [Date of Issuance]

Certificate Number: [Certificate No.]

TO WHOMSOEVER IT MAY CONCERN

Subject: Solvency Certificate for [Applicant’s Name]

This is to certify that [Full Name of Individual/Entity], [Address], [City, State, Pin Code], is a valued customer of [Bank Name], holding account number [Account Number] with our branch.

This certificate is issued in response to [his/her/its] request and attests that, based on our assessment of financial records and documents provided, [Full Name] is financially solvent to the extent of [Amount in Words and Figures] as of [Date].

Signature of Authorized Signatory

[Name of the Signatory]

[Designation]

[Bank/ Institution/ CA Firm’s Name]

[Seal/ Stamp]

Note: This is a generic template, and specific details may vary. Always refer to the issuing authority for the accurate and official format.

The issuance of a Solvency Certificate is typically facilitated by the revenue department and banks, making it a relatively accessible process. Here’s how it generally works:

To evaluate the financial standing of individuals or entities, public sector banks typically require a set of documents when customers request a Solvency Certificate. Here’s an overview of the necessary documents:

Once the bank reviews these documents and is satisfied with the financial standing of the individual or entity, it issues the Solvency Certificate to the customer. This comprehensive set of documents ensures a thorough assessment of the financial health of the applicant.

The processing time for a Solvency Certificate is typically swift and efficient. Once the application, along with the necessary documents, is submitted to the bank, the processing is usually completed within a week. Here’s a breakdown of the key points to keep in mind during the application process:

The fee for obtaining a Solvency Certificate may vary among different banks. However, as a general guideline, most banks typically charge around Rs. 2000 for issuing the Solvency Certificate.

Note: The bank does not bear any liability for future consequences arising from the Solvency Certificate. Typically, the Bank Manager has limited authority to issue a specific number or value of Solvency Certificates. If the certificate issuance exceeds the Bank Manager’s discretionary powers, the request will be escalated to higher-ranking officials for approval. Solvency Certificates are granted exclusively to trusted and reputable customers, and the bank may impose a fee for issuing such certificates.

A Solvency Certificate serves various crucial purposes, including meeting government and legal requirements, participating in tenders, visa applications, securing government and private contracts, and, in some states, for college admissions.

If your Solvency Certificate is not initially granted, the Revenue Officer will review the application, provide feedback or reasons for denial, and may require additional verification or modifications. After necessary adjustments and completion of the verification process, the Solvency Certificate will be issued accordingly.

To obtain a Solvency Certificate, you can submit an application to your bank, the regional Revenue Officer, or the Chief Officer in Charge of Revenue Administration in the relevant district, sub-division, or tehsil. Alternatively, you may approach the Assistant Tehsildar or Assistant District Magistrate.

The fees for a Solvency Certificate can vary, typically around Rs. 2000. However, it's important to note that the fee may differ among banks and financial institutions and could also vary across different states.

Solvency Certificates issued by banks and financial institutions are generally valid for one year. After this period, they need to be renewed. It's crucial to note that the acceptance and validity of Solvency Certificates may vary based on the specific requirements of different authorities or organisations.

You can get a Bank Solvency by applying to your bank. They usually issue it to their customers after reviewing transaction details, account information, and relevant property documents.

No, a Chartered Accountant typically doesn't issue a Solvency Certificate. This certificate is usually provided by banks, financial institutions, or the revenue department of states.

Solvency Details refer to information about an individual's or entity's financial strength. It is often assessed through factors such as bank transactions, account details, and property-related documents.

Banks, financial institutions, and the revenue department of states have the authority to issue a Solvency Certificate. Banks typically issue this certificate to their customers based on transaction details, account information, and available property documents.

A Solvency Certificate is usually issued by the revenue department and banks upon request. Banks, in particular, issue it to their customers after reviewing account transactions and relevant property documents.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.